3 Graphical Application optionmatrix ¶

- Main Screen

- Input Controls

- Date Engine

- Greeks

- Spreads

- Models

- Cash Flow Editor

- Re-calculations

- Cumulative Normal Distribution

- Precision

- Exporting

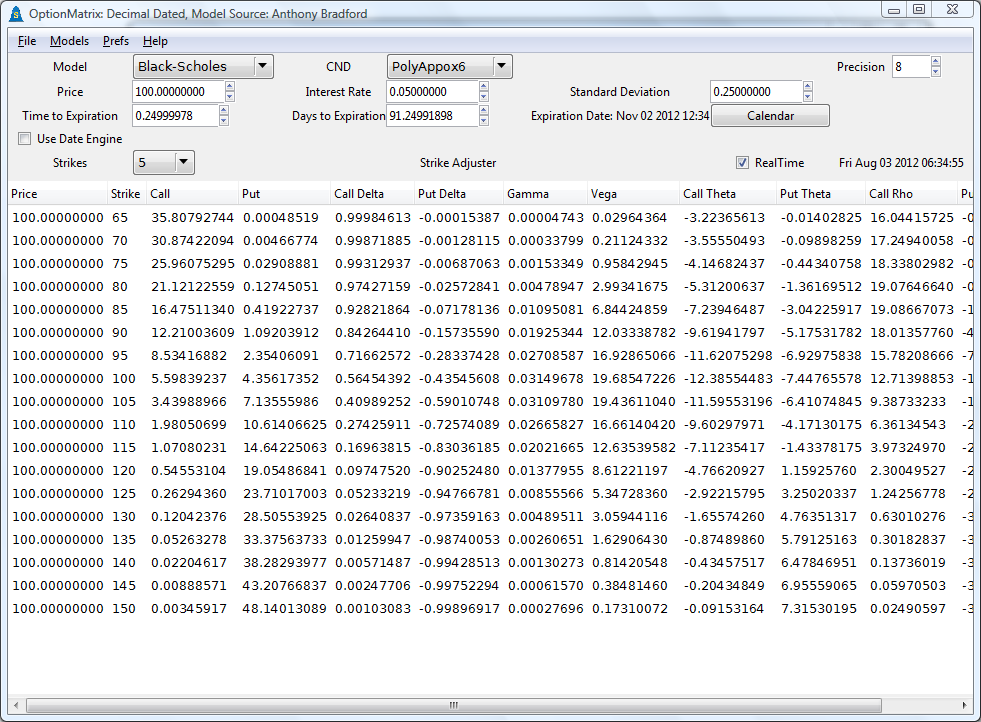

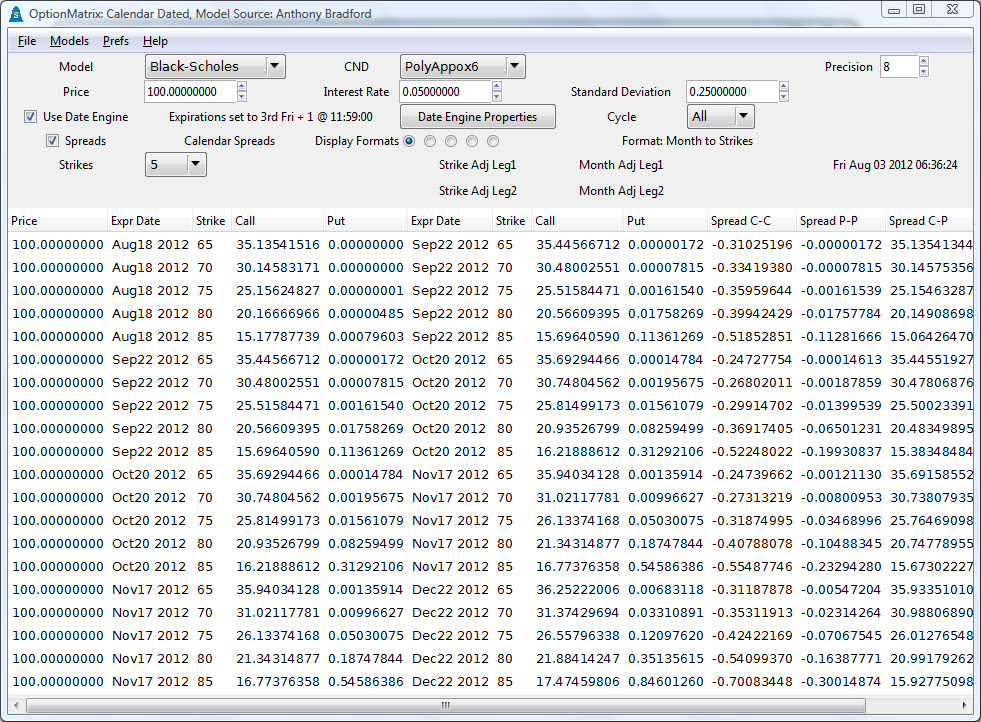

3.1 Main Screen ¶

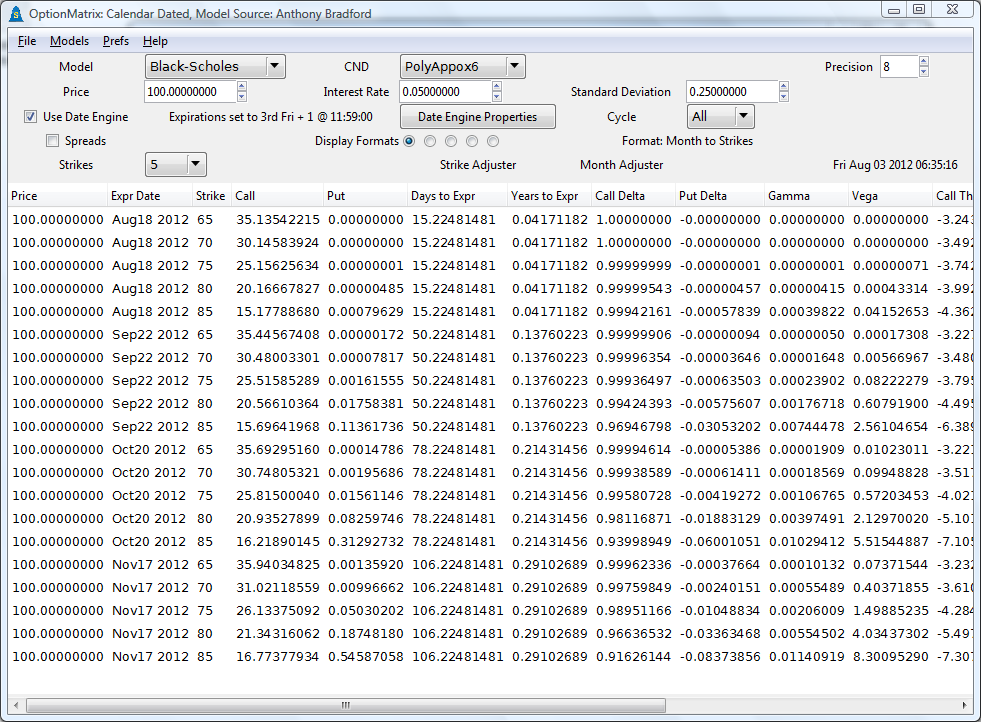

Running optionmatrix with no arguments or just the --debug, -d options will invoke the OptionMatrix GTK+ Graphical Application. The --debug or -d options will cause optionmatrix to create the debug log, optionmatrix.log, in the users home directory or the current working directory of execution. This log file will be populated with diagnostic information while the program is executing.

The initial screen will appear. The default model is Black-Scholes. The option chain on display is being re-calculated every second. Price changes are the result of time bleeding between the current time and the expiration time.

3.2 Input Controls ¶

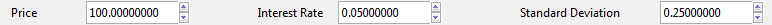

3.2.1 Price, Interest Rate and Standard Deviation ¶

Price, interest rate, and standard deviation can be configured via spin buttons.

3.2.2 Time ¶

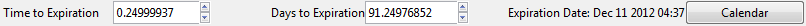

Time can be entered by the “Time to Expiration” or the “Days to Expiration” spin buttons.

“Time to Expiration” displays time to expiration in years. “Days to Expiration” displays expiration time in days.

Input to either spin button updates both. An exact expiration date and time is calculated from the input, the option chain in the calculator’s grid display will be update to the new expiration date. Date calculations are adjusted for leap day of leap years.

Both spin button’s time value decreases every second as the expiration date approaches.

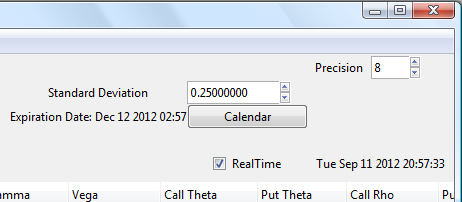

This real-time updating can be toggled with the checkbox “RealTime”.

3.2.3 Calendar Picker ¶

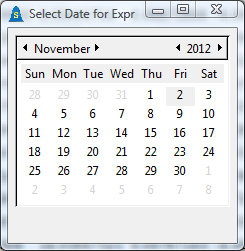

A specific calendar date can be selected with the Calendar Picker.

Calendar date selections will update both the “Time to Expiration” and the “Days to Expirations” spin buttons. Pressing the “Calendar” push button will invoke the Calendar Picker popup.

The popup features year, month and day calendar selections.

Select an expiration date and dismiss the popup. The popup does not feature a “OK” or “Cancel” button. The option chain in the calculator’s grid display will be set to the new expiration date.

3.2.4 Strike Controls ¶

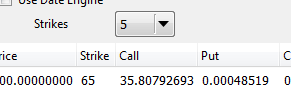

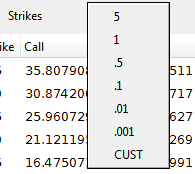

A drop down box “Strikes” changes the strike increments or allows custom strike mode.

Selections include: 5, 1, .5, .1, .01, .001 and CUST

A scale button “Strike Adjuster” allows scrolling of strikes being displayed in the selected strike increments.

Selection of drop down item “CUST” allows entering of any strike in the Strike input box.

3.3 Date Engine ¶

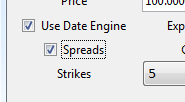

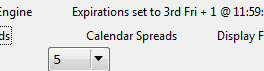

Selecting the checkbox “Use Date Engine” will invoke the Date Engine.

The Date Engine will map option expirations to a default of 3rd Friday+1 @11:59AM going into the future. This is the standard expiration for U.S. Exchange Traded Options. The Date Engine is configurable and can make any re-occuring date used by the options industry.

The option chain’s pricing will be updated as time decreases between the current time and the expirations.

3.3.1 Date Engine Properties ¶

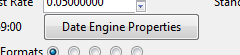

The Date Engine Properties popup is used to configure the Date Engine. It can be invoked by pressing the Date Engine Properties push button.

The default expiration setting of 3rd Friday+1 @11:59AM can be changed.

3.3.2 Month Adjuster ¶

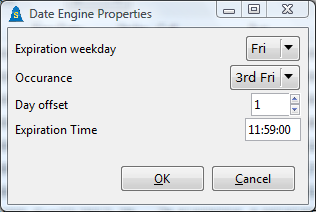

A scale button named “Month Adjuster” can adjust the Date Engine’s months forward.

3.3.3 Option Cycles ¶

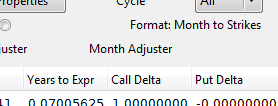

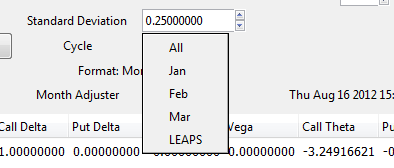

The Date Engine supports option cycles. See drop down with label “Cycle”.

The Cycle drop down includes: All, Jan, Feb, Mar and LEAPS.

The default setting is “All” which displays all months.

3.3.4 Display Formats ¶

The Date Engine supports many display formats for the option chain.

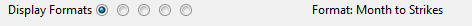

In the grouping of radio buttons labeled “Display Formats” each radio button changes the option chains display format.

The display formats are: Month to Strikes, Months to Strike, Months Across and “3 Call / 3 Put Columns”.

Month to Strikes ¶

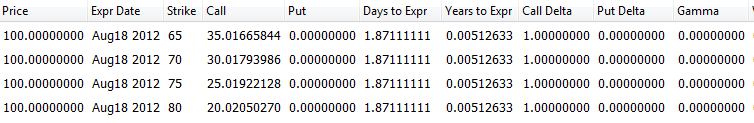

“Month to Strikes” features sets of the same expiration month mapped to incrementing strikes.

Months to Strike ¶

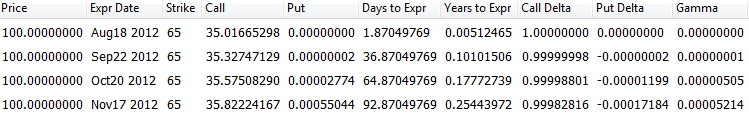

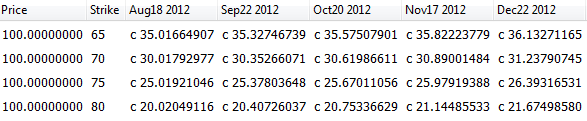

“Months to Strike” features sets of incrementing expiration months mapped to the same strike.

Months Across ¶

“Months Across” features sets of calls, puts, incrementing strikes and incrementing expiration month columns. The calls have the letter ’c’ before the price while puts have the letter ’p’ before the price.

3 Call / 3 Put Columns ¶

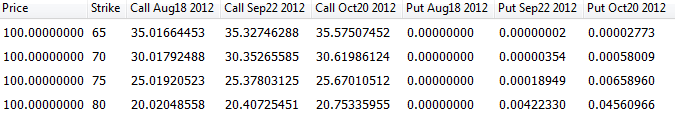

“3 Call / 3 Put Columns” features incrementing strikes with 3 Call Columns and 3 Put Columns.

3.4 Greeks ¶

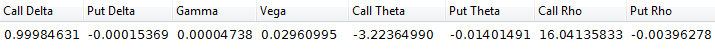

Option analytics of Call Delta, Put Delta, Gamma, Vega, Call Theta, Put Theta, Call Rho, Put Rho are calculated. They can be seen on the row at the top of the option chain.

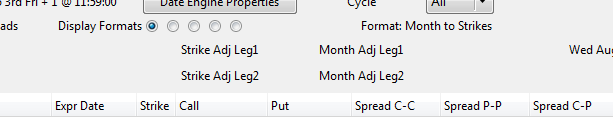

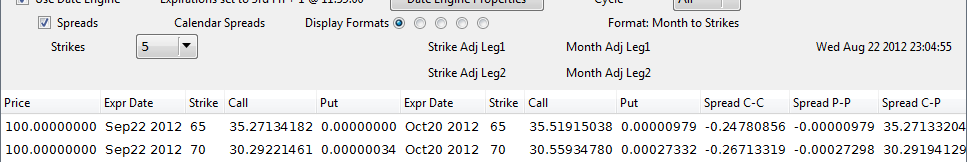

3.5 Spreads ¶

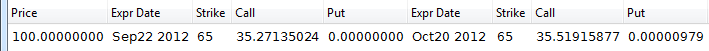

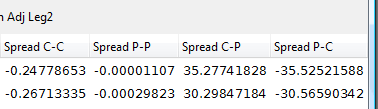

Selection of the checkbox “Spreads” will invoke the Spread Mode.

Spread Mode allows the individual leg information for a spread to be controlled.

Scale buttons “Strike Adj Leg1” and “Month Adj Leg1” can be used to adjust strikes and months for Leg 1. Scale buttons “Strike Adj Leg2” and “Month Adj Leg2” can be used to adjust strikes and months for Leg 2.

Spreads are displayed on a per row basis.

The first set of column references to “Expr Date, Strike, Call, Put” is

considered Leg 1. Use scale controls “Strike Adj Leg1” and “Month Adj Leg1” to adjust.

The second set of column references to “Expr Date, Strike, Call, Put” is considered Leg 2. Use scale controls “Strike Adj Leg2” and “Month Adj Leg2” to adjust.

Four spreads are computed “Spread C-C” (Leg 1 Call minus Leg 2 Call), “Spread P-P” (Leg 1 Put minus Leg 2 Put), “Spread C-P” (Leg 1 Call minus Leg 2 Put) and “Spread P-C” (Leg 1 Put minus Leg 2 Call).

Spread views are automatically labeled Vertical Spread, Calendar Spread or Vertical Calendar Spread.

Vertical Spread indicates strike differences between Leg 1 and Leg 2 (expiration dates are the same). Calendar Spread indicates expiration date differences between Leg 1 and Leg 2 (Strikes are the same). Vertical Calendar Spread indicates strike and calendar date expiration differences between the legs.

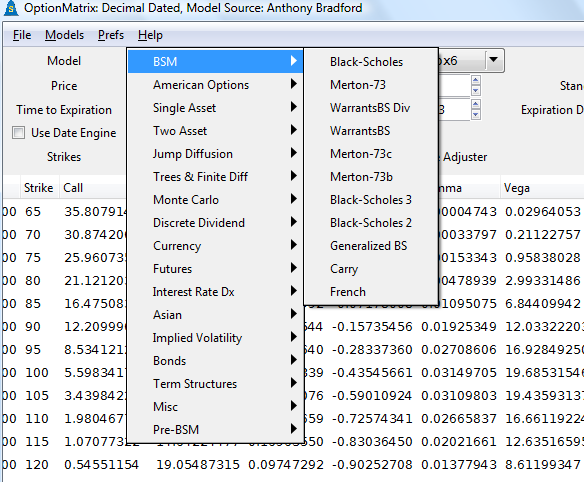

3.6 Models ¶

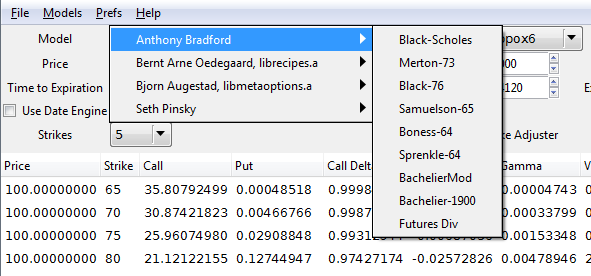

Over 171 option models are featured in the OptionMatrix Calculator. Model numbers may vary between systems due to library and linker options.

3.6.1 Changing Models ¶

The current pricing model can be changed with the “Model” drop down. The models are listed as categorized folders in the drop down.

3.6.2 Model Categorization ¶

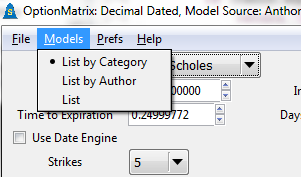

The model drop down box categorization can be controlled via the menu item “Models”. Options include:

Models → List by Category, Models → List by Author and Models → List.

Models → List by Author, changes the categorization in the “Models” drop down to be based on author of the model.

Models → List, creates no categorized folders. The “Models” drop down box becomes a list of all models.

Models → List by Category, is the default.

3.7 Cash Flow Editor ¶

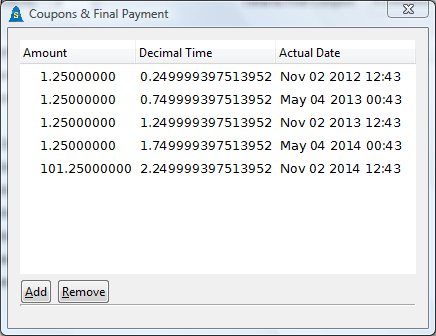

Some models have multiple dividends or coupons. optionmatrix provides a cash flow editor to add / remove these cash streams. The cash stream is ordered by time. If the “RealTime” checkbox is enabled the dividend or coupons time will bleed.

3.8 Re-calculations ¶

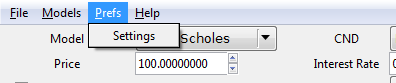

Selection of Menu item Prefs → Settings will invoke the “Settings Popup”.

The setting “Sleep Delay” controls the time in between option chain re-calculations in seconds. The default setting is 1.

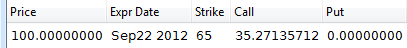

3.9 Cumulative Normal Distribution ¶

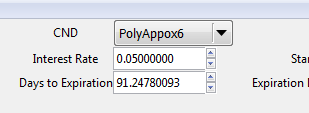

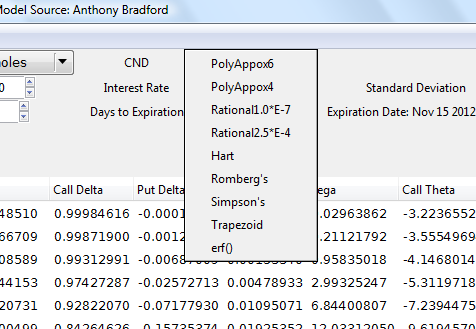

The method of calculating the Cumulative Normal Distribution is controlled with drop down named “CND”.

Methods include: PolyApprox6, PolyApprox4, Rational1.0*E-7, Rational2.5*E-4, Hart Equation, Romberg’s Method, Simpson’s Rule, Trapezoidal Rule and erf().

PolyApprox6 is the default.

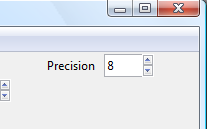

3.10 Precision ¶

Decimal place precision can be adjusted with the spin button “Precision”.

Precision is defaulted to eight decimal places to show real-time time bleeding.

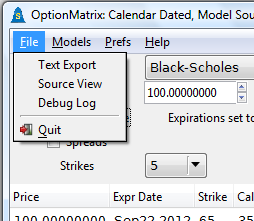

3.11 Exporting ¶

Two menu export options are available.

File → Text Export, exports the current option chain to a text window.

File → Source View, exports the current option models C/C++ source code to a text window.

OptionMatrix

© 2013 Anthony Bradford